Recovery of European construction after the financial and Euro crisis

The financial crisis had a drastic impact on the economy of Europe and especially on the construction sector. European GDP contracted about 4% in 2009. In 2012 it contracted slightly again as a result of the Euro crisis. Construction declined for six years since the peak in 2007 to the trough of 2013: over 25% in total. Contraction varied a lot by sectors: new housing construction fell the most, nearly 50% while renovation contracted the least at 6%.

The impacts of the financial crisis differed widely by countries. For example, construction in Poland, Switzerland, Belgium, Germany and Norway declined hardly at all whereas the overheated construction sectors of the crisis countries downright collapsed: to a fifth in Spain and to a quarter in Ireland from the 2007 peak.

European construction as a whole returned to a growth track in 2014 and has remained on it since. The most recent EUROCONSTRUCT forecasts (November 2016) predict growth until 2019. Then, the real volume of construction will still be 15% lower than in 2007.

The ratio of total construction to GDP has been declining slowly in Europe from the mid of the 1990’s. In 2006 construction was a good 13% of GDP and reached a low of 9.4% in 2014. According to the most recent forecast, the ratio will be 9.6% in 2019 which means that construction will grow only slightly faster than GDP.

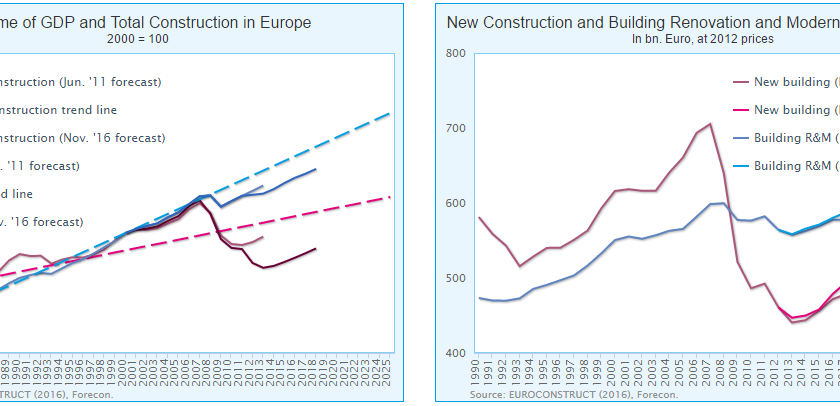

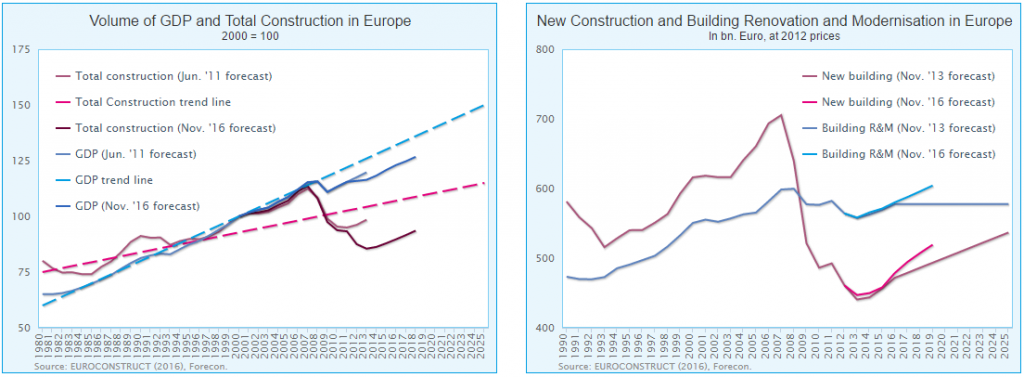

EUROCONSTRUCT makes no medium-term forecasts, but Forecon reviewed the economic outlook until 2020 at the 2011 Helsinki Conference and the outlook until 2025 at the 2013 Prague Conference. In the following I evaluate the realisation of the outlined development path.

European GDP has grown slightly slower since 2011 than predicted (Chart 1). The key contributing factor has been the Euro crisis that ended economic growth in 2012 and caused a lot of economic uncertainty which resulted, for instance, in the postponement of decisions about construction investments. GDP growth in 2016–2019 will be somewhat faster than predicted in 2011, but the 2020 forecast will not be reached.

In the early part of the 2010’s construction growth stayed below the short-term forecast made in 2011, and the euro crisis was responsible for its decline for the next 2-3 years. Since growth began in 2014, the growth gap has been reduced. The quite slow economic growth (1.3% p.a., Conference Board, November 2016) in the first half of the 2020’s will lower European construction growth to 1.5%.

The 2013 building construction forecast (Chart 2) dealt separately with new building construction and renovation. The short-term predictions made in 2013 have been realised to a large extent. Renovation will reach the 2008 volume in 2017. The sector is expected to grow more rapidly in the next few years than the 2013 long-term forecast predicted. The ageing of the building stock and the good financial standing of consumers have accelerated renovation growth. The new-construction forecast was based on the fact that since the volume of new construction shrank drastically earlier, economic growth will speed it up more than renovation. The forecast for new construction until 2025 has stayed fairly well on the track predicted in 2013. The present low level of interest rates is boosting both renovation and new construction as well as economic growth. However, a US-driven rise of interest rates has already begun and the impact of low interest rates on European construction will take effect from the beginning of the 2020’s.

Growth prospects vary in different parts of Europe. The wealthy countries have an abundance of dwellings, non-residential premises and infrastructure which means that construction growth will lag slightly behind economic growth. In countries where the construction sector overheated and collapsed after the financial crisis, construction will outpace economic growth in the next few years.

The CEE Countries need a lot of new construction – both buildings and civil engineering. The realisation of their needs requires stronger economic growth than in the rest of Europe which makes construction growth possible. In Southern Europe construction was on an unsustainably high level before the financial crisis (17% of GDP) but fell to 10% in 2013. The Nordic construction output had grown moderately before the financial crisis and the construction slump was fairly short-lived and cyclical. Nordic construction has been growing rapidly over the last few years. Economic forecasts for it are also better than the European average. The fluctuations in construction in Western Europe have also been quite small. Brexit will weaken Western European economic and construction growth to slightly below the European average. Economic growth in total Europe has launched growth of construction, but the only slightly faster growth increases construction as a share of GDP slowly, which means that the share could reach 10% in 2025.